How to Spot Pump & Dump Stock Scam ?

Understanding how a pump-and-dump scam works, why the share market is especially susceptible, and How to Spot Pump & Dump Stock Scam will help you avoid getting taken by these schemes.

What is Pump & Dump Stock Scheme Scam ?

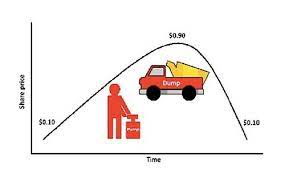

Pump and dumps refer to the scam of raising the price of vulnerable stocks using misleading promotions and selling off the shares once their price booms. After voluminous selling and the hype wearing off, the share price dips sharply, leaving many investors in heavy loss.

Pump: Fraudsters post messages online that encourages investors to buy a stock quickly by claiming they have access to confidential data.

Dump: Once the prices increase, the perpetrators sell their shares at a high rate. New investors then lose their money if the prices drop dramatically after the traders sell their shares.

Pump-and-dump traders use social media platforms or messaging apps to start rumors, spread misinformation, or hype to increase interest in the security to increase its price.

Pump and dump schemes mostly target small-cap stocks, as they can be easily manipulated. While pump and dump schemes used to be directed primarily toward penny stocks, cryptocurrencies are now joining the fray as well.

Types of Pump and Dump Schemes

1. Classic pump and dump scheme

This scheme involves the manipulation of information regarding a company and its stocks via telephone, fake news releases, and distribution of some “inside” information that can boost the stock price.

2. Boiler room

A small brokerage firm employs several brokers that use dishonest sales practices to sell investments to investors. The brokers sell stocks by cold calling. They sell as many shares as possible required to boost the price. Once the stock price rises, the brokerage firm sells its portion of the stock for a hefty profit.

3. “Wrong number” scheme

You may receive voicemails with an insider investment. The fraudsters try to make it look like voicemail was accidentally sent to you. It is a targeted action to attract the attention of potential investors to a particular stock and boost the demand for this stock.

You can also watch this short YouTube video for better understanding https://www.youtube.com/watch?v=7dF1JTBdcGg .

Are Pump and Dumps Illegal?

As we know now, stock price manipulation using misleading information often steals the victims’ hard-earned money. Hence, various laws and acts considers the scheme illegal. Laws such as the Securities Act of 1933 and the Securities Exchange Act of 1934, etc., contain segments to criminalize misstatements and frauds related to securities.

Depending on the case, there are other laws as well that can penalize an offender. The SEC stays vigilant to spot any instance of stock price manipulation. The regulatory body keeps charging the offenders to ensure the safety of innocent investors who bear the brunt of manipulation.

How to Spot Pump & Dump Stock Scam ?

The good news is that pump-and-dumps, like many frauds, throw off plenty of recognizable warning signs. Watch for these if you ever get excited about a fast-moving stock, especially one with a low share price.

Avoid FOMO Trading | How to Spot Pump & Dump Stock Scam

One of the easiest ways to convince unsuspecting investors to pile into a security is when its price is skyrocketing. When a security is jumping in price by leaps and bounds, it’s hard not to be interested. The desire to join in on the price movement clouds your judgment, makes it difficult for you to perform the necessary analysis of the stock before placing a trade. We call this FOMO ( Fear Of Missing Out ) trading. You can avoid FOMO trading by following tips in the following article.

5 Tips to avoid FOMO when Trading (https://thebrightdelights.com/5-tips-to-avoid-fomo-when-trading/)

Be Skeptical about Social Media and Messages | How to Spot Pump & Dump Stock Scam

Social media like Facebook, YouTube, WhatsApp & Telegram broadcasting messages have broader reach that requires even less effort than sending emails by scammers to reach millions of captive readers. Anytime you get unsolicited advice from some page or such source who is not registered or licensed, take it with a huge grain of salt. Message boards promoting stocks have been all the rage in 2020 and 2021, as so-called “meme stocks” or “YOLO stocks” like GameStop and AMC Entertainment have skyrocketed.

Avoid that Unsolicited Email | How to Spot Pump & Dump Stock Scam

f you’re checking your email one day and you receive an unsolicited email about a stock or crypto, you might very well be on the receiving end of a pump and dump scheme. Pump and dump scammers are looking to reach the broadest audience possible to get money flowing into their targeted securities. One of the easiest ways to do this is to send out millions of unsolicited emails to potential targets. Even if only 0.01% of 1 million recipients actually click on the email and respond, that amounts to 100 people buying the touted security.

Independently Verify Claims | How to Spot Pump & Dump Stock Scam

It’s easy for a company or its promoters to make grandiose claims ! Claims about new product developments, lucrative contracts, or the company’s financial health. But before you invest, make sure you’ve independently verified those claims. If you find yourself getting sucked into a pitch from one of these scam artists, do yourself a favor. And the favor is always conduct your own research!!

Final Takeaway

Popular movies like Boiler Room and The Wolf Of Wall Street have portrayed the brokerage firms from the 1990s that became famous for orchestrating pump and dumps, with naïve affluent clients as their victims. There are no easy ways to get rich quick in the stock market. Always keep this investment caveat in mind: “If it’s too good to be true, it probably is.” It’s vital that you do your own research about any investment and watch over given signs above.